In the rapidly changing world of trading, having the appropriate tools can make the difference between success and failure. As markets vary rapidly and the flow of data becomes increasingly complex, traders find themselves at a crossroads. Should they rely entirely on intuition and their background, or do they utilize the power of software tools to improve their strategies? The answer is obvious: taking advantage of advanced trading systems can substantially elevate a trader's results.

Software tools have transformed the landscape of trading by offering essential insights and automating complex analyses. https://www.tradesoft.es/ help traders make educated decisions based on up-to-date data, market trends, and predictive algorithms. When used effectively, a well-designed trading system can both simplify the trading process but also lead to more consistent gains. By embracing technology, traders position themselves to navigate the complexities of the financial markets with confidence and efficiency.

Determining the Correct Investment Platform

Choosing the suitable investment software is crucial for any investor looking to boost their returns. Commence by assessing your trading style and goals. Diverse systems cater to different approaches, whether you are a short-term trader, medium-term trader, or long-term. Recognize the features that match with your investment strategy, such as charting features, technical analysis tools, and safety measures features.

Client experience is another important aspect to consider when choosing trading platform. A simple interface can significantly improve efficiency and assist you make quicker choices under pressure. Search for platforms that provides a clean design, easy navigation, and customizable interfaces. Testimonials and samples can give information into the ease of use and performance of the platform before making a decision.

Lastly, consider the cost and customer assistance provided by the platform provider. Certain services may incur commission fees or monthly payments, while some might be complimentary but restrict features. Look for software that fits your budget while still providing vital tools needed for your investment system. Additionally, trustworthy user assistance can be invaluable during technical issues or when you need assistance navigating advanced features.

Essential Elements of Efficient Trading Instruments

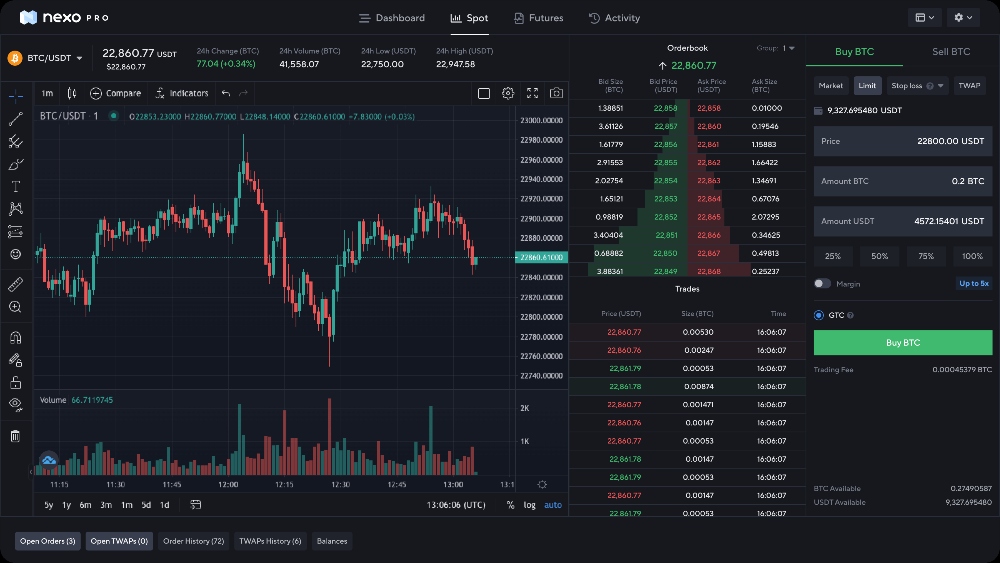

Effective trading tools are developed with distinct attributes that enhance the trading journey and help traders make educated choices. One key feature is live market data. Access to live price feeds and market updates enables traders to respond immediately to market changes, keeping their edge in fast-moving environments. Having precise and up-to-date information allows traders to place orders at optimal prices and avoid missing advantageous opportunities.

A further important feature is adaptable charting options. Efficient trading tools provide users with easy-to-use charts that can be adjusted to their preferences. Traders can modify indicators, time frames, and chart types to align with their strategies. This degree of personalization allows for better analysis and visualization of market trends, helping traders identify patterns and make predictions based on historical data.

Additionally, robust backtesting functionalities are vital for any powerful trading platform. This feature allows traders to test their strategies against past data to assess their potential profitability before participating in live trading. By simulating trades with historical market conditions, traders can enhance their methods, spot weaknesses, and enhance their overall trust in their trading strategies, ultimately boosting their odds of success.

Integrating Technological into One's Trading Strategy

Blending technological solutions within the trading approach can greatly improve an decision-making process. Through employing cutting-edge analytics and graphical data display, traders can rapidly examine market movements and identify lucrative opportunities. Technological tools can simplify monotonous tasks, allowing traders to concentrate on developing strategies and implementation. Such an integration not only improve effectiveness and also lowering the psychological pressure connected to making trading decisions.

In addition, a thoughtfully chosen trading platform is able to assist traders implement their tactics with exactness. Several software platforms offer backtesting features that enable investors to evaluate the viability of their plans with historical data. This practice offers invaluable insights into expected results and assists refine trading tactics. By integrating these tools in everyday activities, traders can easily develop confidence with respect to their approaches and respond rapidly to changing market environments.

In conclusion, adopting digital solutions promotes more effective risk management. Featuring risk assessment features and tailored notifications, traders can set specific parameters for both entry and exit points. Such a proactive approach allows them to adhere to their risk thresholds and safeguard their funds. By integrating a robust trading solution, investors are not only better prepared to take advantage of opportunities and they can also protect their resources in fluctuating markets.